Revolutionising Global Trade with Blockchain & Digital Assets

Empowering Global Trade with Instant, Cost-Efficient & Programmable Payments.

At Bloom Fintech, we are transforming global trade and supply chain finance through the power of Web3 Payment Finance (PayFi) and the tokenisation of real-world trade finance assets.

As a PayFi pioneer, we deliver seamless, secure, and cost-efficient payment solutions, powered by smart contracts and AI agents, to help bridge the multi-trillion-dollar global trade finance gap with speed and scale.

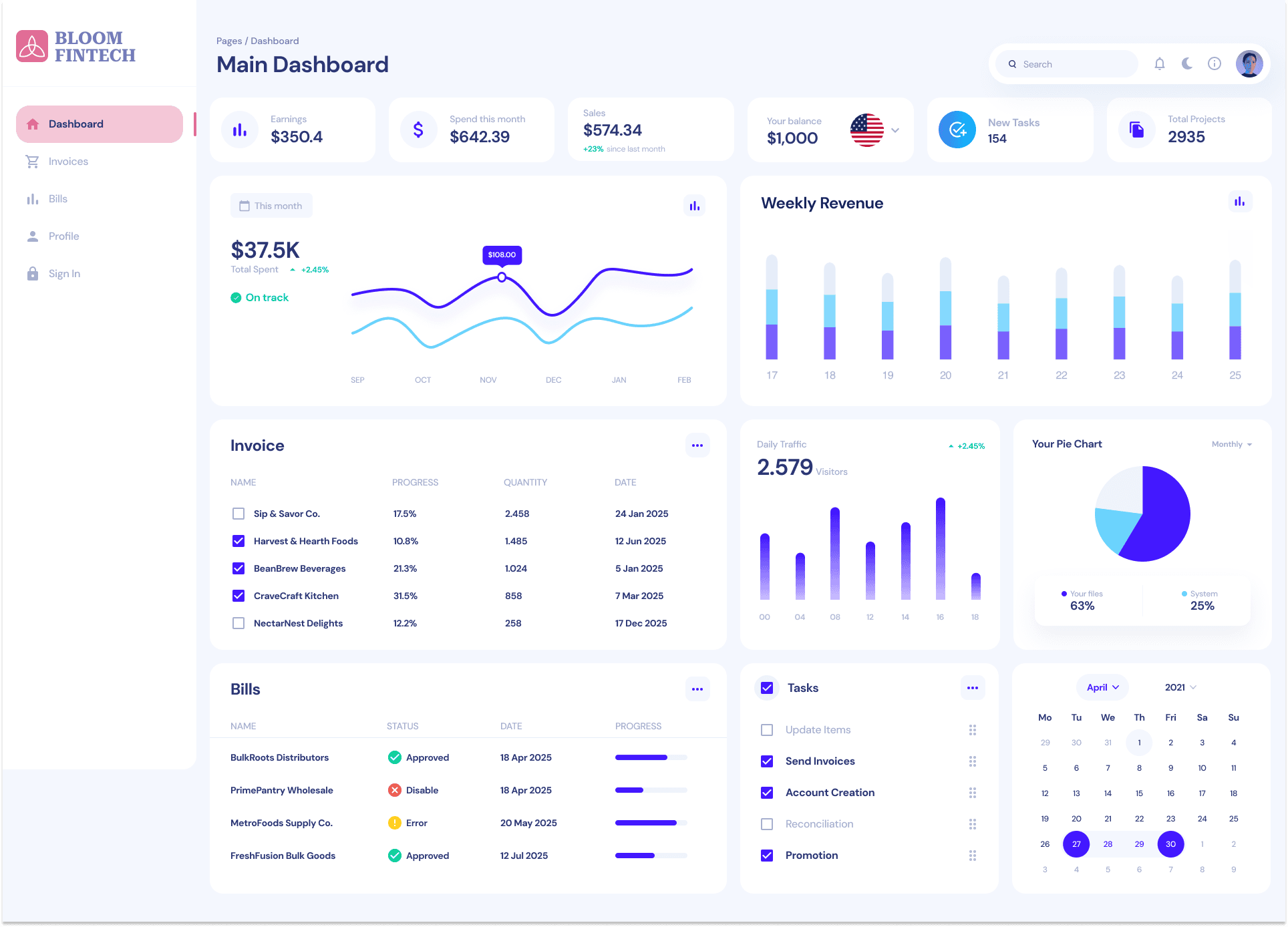

How Bloom Fintech Works

Our platforms provides an end-to-end solution for global trade finance

Tokenised Invoices

Tokenised invoices are next-generation financial assets issued natively on-chain. They are traceable, immutable, easily fractionalised, and composable, making them highly effective for supply chain and trade finance applications. These tokens allow a single invoice to be divided into multiple units, enabling shared ownership, transferable claims, and fractional payments and receivables tied to the underlying asset. Moreover, tokenised trade instruments provide real-time visibility and updates, enhancing transparency and control over the financial position and performance of the asset throughout its lifecycle.

Programmable Payments

At Bloom Fintech, we enable stablecoins to be used directly for payments or wrapped in programmable tokens with predefined usage conditions, enabling secure, transparent, and efficient cross-border payment flows. By reducing reliance on intermediaries, our infrastructure lowers transaction costs and accelerates settlement times. Our solutions support automated, conditional payments, secure escrow arrangements, and seamless interoperability across a range of digital currencies. It streamlines trade execution creating a more inclusive, agile, and resilient global trade and payment ecosystem.

Smart Contract Automation

It enables the execution of predefined agreements directly on the blockchain without the need for intermediaries. Once deployed, these self-executing contracts automatically enforce terms based on programmed logic, reducing manual intervention, errors, and delays. This technology is particularly powerful in financial services, supply chain management, and insurance, where conditional payments, settlements, and compliance checks can be triggered in real time. By embedding trust and automation at the protocol level, smart contracts streamline operations, lower costs, and increase transactional transparency.

Enhanced Liquidity

Converting liquid trade finance assets into digital tokens allows businesses to access a global pool of investors, transforming traditionally illiquid receivables into tradable assets. This process improves cash flow, reduces capital lock-up, and increases operational flexibility. By embedding digital assets within programmable and interoperable blockchain-based payment infrastructure, businesses can unlock liquidity, and reduce operational costs. This enables scalable financing, eliminating the inefficiencies of traditional processes and paving the way for more growth driven operations.

Why Choose Bloom Fintech?

Borderless Transactions

In today’s global economy, businesses face persistent friction in cross-border transactions, delayed settlements, inflated fees, and a maze of intermediaries. At Bloom Fintech, we’re eliminating these barriers through blockchain-powered Web3 payment methods.

Our platform empowers businesses to send and receive payments in real time, securely, transparently, and without geographic limitations. By eliminating legacy inefficiencies and reducing transaction costs, we accelerate capital flow, lower overheads, and enable you to focus on what matters most: growth.

With Bloom Fintech, global trade becomes simpler, smarter, and truly borderless.

Tokenised Trade Finance Assets

At Bloom Fintech, we bring trade finance into the digital age by tokenising real-world trade assets and financial instruments — such as invoices, letters of credit, receivables, and bills of lading, on blockchain infrastructure. These are not mere digital copies, each tokenised asset is blockchain-native, immutable, and verifiable, ensuring authenticity, traceability, and security.

For businesses, this means faster access to working capital through real-time settlement and reduced reliance on traditional intermediaries. For supply chain financiers and investors, it unlocks a new class of high-quality, yield-generating assets, improving liquidity and enabling global, 24/7 participation in trade finance markets.

Bloom Fintech is building a smarter, borderless future for global trade — one asset at a time.

Security &

Compliance

At Bloom Fintech, security and compliance are at the core of everything we build.

Critically, Bloom Fintech is built with global legal compliance in mind. From KYC/AML to cross-border trade regulations, our architecture is aligned with the regulatory frameworks governing international finance and trade. This gives businesses the confidence to scale across jurisdictions, knowing their operations are safeguarded by both cutting-edge technology and robust legal standards.

Choose Bloom for a future where security, automation, and compliance work together — seamlessly.

Benefits of Using Bloom Fintech

For Businesses

Faster access to working capital

Reduced transaction costs

Automated payment processes

Enhanced supply chain resilience

For Investor

Access to a new asset class with strong risk-adjusted returns

Enhanced portfolio diversification

Transparent and secure investment environment

For Financial Institutions

Improved capital efficiency

New revenue streams from tokenised assets

Streamlined operations through digital platforms

Join the Web3 Trade Finance Revolution

Bloom Fintech is transforming payment finance by integrating advanced technology with established financial systems. Whether you're a corporate buyer, supplier, financial institution, or investor, our platform provides the tools to optimise working capital, improve cash flow, and expand access to global trade opportunities through secure, efficient, and scalable payment infrastructure.

Get in Touch – Explore how Bloom Fintech can transform your trade finance operations.

Partner with Us – Collaborate to drive tokenised finance forward.

Invest in the Future – Join us in shaping a more inclusive and efficient trade finance ecosystem.